Why is it important to make a will in Dubai if you own a property or business

Do you own a property or company in the UAE? The next step after the purchase is to draw up a will in Dubai. Without it, your heirs will face lengthy and expensive legal proceedings. In the UAE, the principle of “everything goes to the family automatically” does not apply.

Succession litigation can take up to several years, especially for non-residents. Therefore, a will is a legal reservation that will provide for your loved ones.

Legal framework: what is the basis for a will for non-Muslims in Dubai

Since 2023, the Emirates has had laws that allow non-residents and non-Muslims to freely dispose of their property through a will:

• Law No. 15 of 2017 — on the implementation of non-Muslim wills in Dubai (including DIFC);

• Federal Decree-Law 2023 on personal status — allows non-Muslims to transfer assets at their discretion;

• A separate inheritance department has been created under Dubai Courts.

You can issue a will:

• through Dubai Courts (State Court, Notary Public)

• through DIFC Wills Service Center (private jurisdiction),

• through your country's consulate (if this option is available).

How to make a will in Dubai Courts: requirements

In order for your will to be recognized in Dubai, it is important to comply with official requirements.

Who can issue a will:

• The tester is a non-Muslim, over 21 years old;

• At the time of registration, he is in his right mind and fully functional.

Language and form:

• The will must be in Arabic or bilingual (English+Arabic);

• The translation is performed by a licensed translator registered with the UAE Ministry of Justice;

• Only a written printed document, by hand, is unacceptable.

Mandatory sections of the will:

- The tester's personal data — full name, passport, Emirates ID, address, religion (it is indicated that you are Non-Muslim).

- Cancellation of previous wills is mandatory.

- Appointment of the executor of the will (executor) — with powers and contacts.

- Description of heirs and assets — apartments, shares, bank accounts, investments.

- Property distribution — specific properties or percentages.

- The “balances” clause is for assets that are not directly specified.

- Child custody — if there are minor heirs.

- Signatures and witnesses are two adult witnesses who are not heirs.

Step-by-step guide: how to register a will in Dubai Courts

- Preparing a will

Compiling by a lawyer, bilingual version (EN/AR), with notarization. - Online upload to Dubai Courts

A will is sent through e-services for preliminary review. - Notary Public Visit

Signing a will in the presence of a lawyer and two witnesses. - Payment of duty

Approximately AED 2,000, payable on the day of submission. - Official registration and storage

The will is stored in the Dubai Courts database and is used when opening a probate case.

Features and limitations

• A will in Dubai Courts covers properties across the UAE — as opposed to DIFC, which is only valid in Dubai and Ras Al Khaimah.

• Important: If you are a Muslim, your inheritance falls under Sharia law by default, and the scheme will be different.

• Having assets both in the UAE and abroad, it is better to issue two wills: one in Dubai and the other at the place of citizenship.

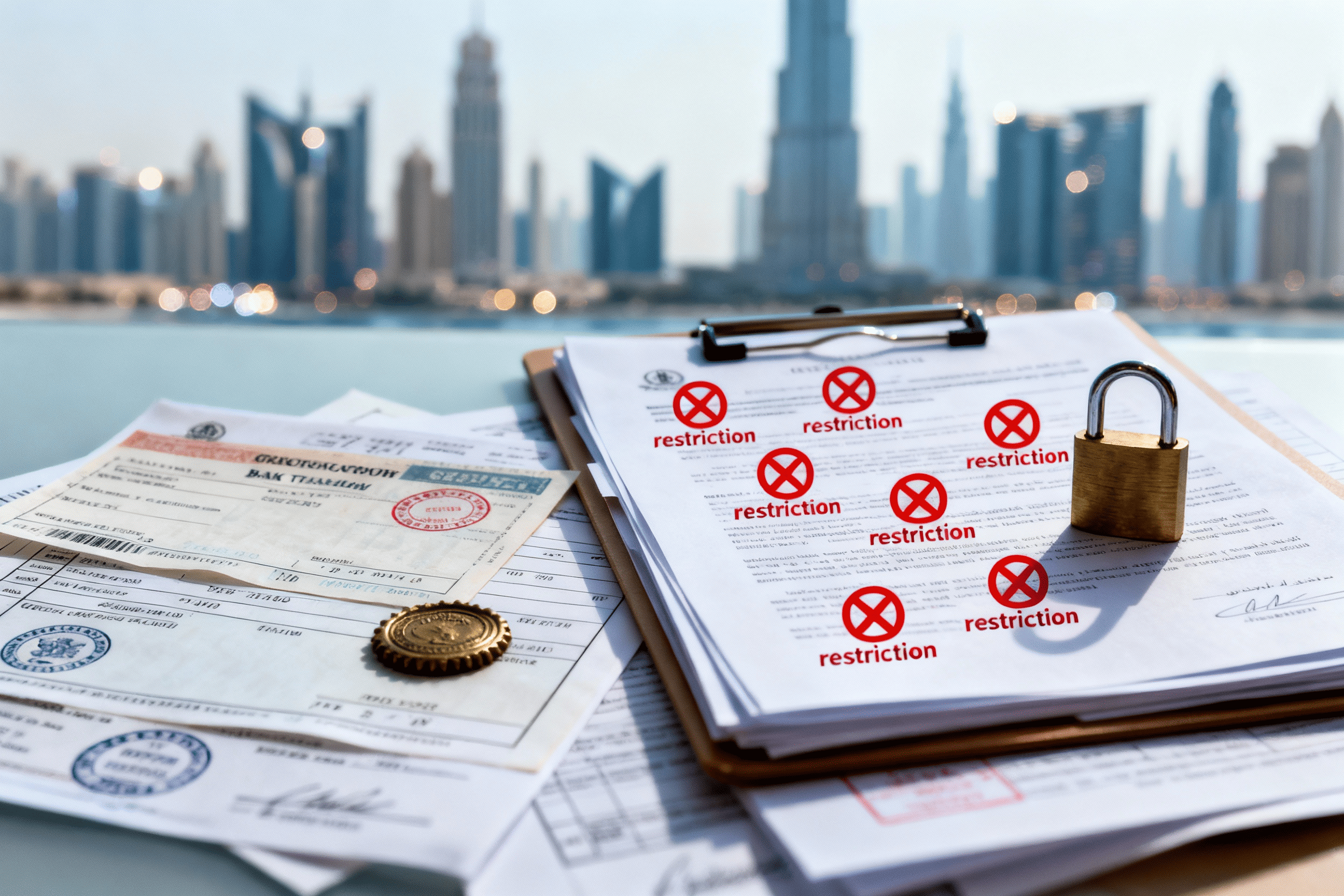

What happens if there's no will?

If a property owner in the UAE dies without a will:

• An inheritance case is opened on the basis of Sharia norms (even if you are not a Muslim);

• The procedure can last from 6 to 24 months;

• Assets can be frozen before a court decision is issued;

• Expenses for lawyers, translations, and legalization are increasing sharply;

• Child custody is decided by the courts — even if the child has a parent who remains.

Conclusion: when and why to make a will in Dubai

If you are:

• We bought a property in Dubai;

• You own a company or a share in a business;

• You have bank accounts, deposits, investments in the UAE;

then you need to issue a will, especially if you plan to transfer the property to exactly the people you want to transfer it to.

How we can help

The team Green City Real Estate collaborates with lawyers who:

• Will make a will for Dubai Courts;

• They will translate and register it;

• They will advise on tax and legal consequences.

We will help you not only buy property in the UAE, but also protect it correctly for your heirs.

.avif)